Due to the increasing needs for convenience and COVID-19 not appearing to be going anywhere soon, consumers are changing the way they manage their money, pay for goods and services, finance large purchases, etc.

Because of this, financial service companies are presented with a powerful opportunity to engage consumers and add value to the overall user experience. However, these companies must first understand what digital consumers want and how to face the challenges that lie on the path before them.

How Digital Consumers Are Banking Today

For the most part, consumers are comfortable going online to manage their finances. In fact, roughly 60 percent of the entire internet population in the United States will visit one of the top 20 financial institution websites—at minimum—on a regular basis.

Up from 26 percent in 2020, 32 percent of surveyed consumers prefer to bank digitally and avoid their local branches completely. However, there are still some consumers who want the best of both worlds: digital banking and in-person banking when needed.

Now, when it comes to consumers who are dependent on local branches, there has been a sizable reduction since the pandemic started. Before the pandemic, 42 percent wanted to go into their local branch, but after the pandemic, this number dropped to 35 percent.

These percentages are all due to consumers growing more and more comfortable banking digitally. This is particularly true with the younger generation, who are open to alternative banking options, such as online banking. It is expected for this to continue and local financial companies to become less and less relevant.

What Do Digital Consumers Expect from Financial Companies?

Digital consumers want to ensure they still get a personalized experience from online financial companies. Personalization is very strong in brick-and-mortar banking, and it is imperative that this crosses over into digital banking.

Consumers are unhappy with large financial companies due to the endless fees that they are charged, especially when they consider the limited or lack of complete financial advice that they receive for being a loyal customer. In addition, consumers want to receive financial advice that is tailored to their personal situations. However, when banking online, this is less likely.

Further, digital consumers want a hybrid interaction that consists of digital services and live help. This allows them to bank at their convenience but also get personalized attention when help is needed.

What Are the Main Challenges Financial Companies Face While Going Digital?

One of the main challenges that financial companies face while going digital is being able to meet or exceed customer expectations and building trust with consumers.

In addition, digital banking services are quick and efficient, which potentially keeps customers from hanging around. This makes cross-selling far more difficult online than it would be face-to-face at a brick-and-mortar institution.

So, for financial companies to be successful in going digital, they must learn how to use valuable solutions and tools to their advantage, which will ultimately increase engagement and the potential to cross-sell their products and services.

To start with, financial companies must look at how they increase a personalized user experience. Consumers may want digital, but they want that personal interaction and feel for their experience as well.

Further, consumers want to learn more about financial wellness, which includes credit improvement education, identity protection services, and more. Financial companies can take these solutions, adapt them to their brand, and implement them, potentially increasing customer engagement and cross-selling opportunities while also adding value to the overall user experience.

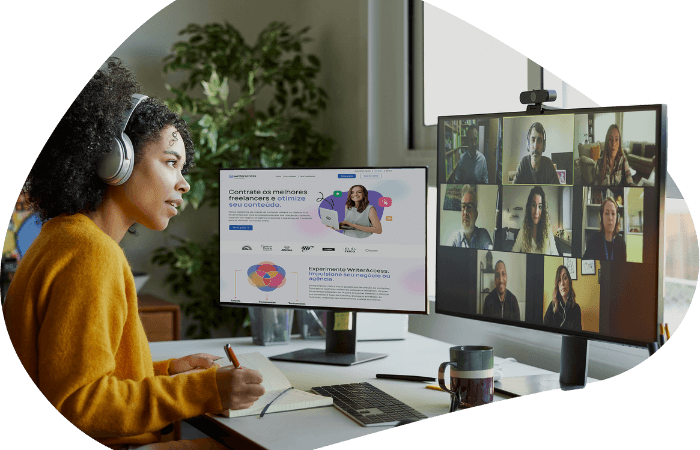

Another challenge financial companies are facing is finding quality team members. When customers want a digital service with a human touch, the right people need to be hired to perform these services in order to serve customers well.

It has been reported that almost 70 percent of companies who are switching to digital find it difficult to transition their employees to remote work. This is despite the fact that the pandemic warranted employees to work remotely from the comfort of their home.

Therefore, financial companies must prioritize locating the right talent and equipping them with the proper knowledge and tools to be efficient and helpful to customers, potentially improving the overall user experience.

How Can Financial Companies Build Trust Around Digital Payments?

Although digital payments and banking have come quite a long way, the fact of the matter is that distrust still remains. There are more consumers who have a worsening perception of security surrounding digital payments within the last year as opposed to those with an improving perception.

One of the areas where consumers have the most concern is making payments via social apps.

So, what can financial companies do to build trust and create a heightened perception of digital payments with consumers?

First, they can give consumers what they want, which is more than anything a human touch to their banking services. While going digital is indeed what most consumers want, they don’t want to be left in the dark when they need assistance either.

Therefore, financial companies need to provide an actual human being who can understand the consumer’s needs and problems and then address them accordingly. This can be done by using online or video chats with real people instead of a robot.

Another thing financial companies need to do to increase trust around digital payments is providing good content that educates the audience about security measures and what should they do to increase their security. It can be blog posts, interactive content, videos, tutorials and so on.

One of the main problems that consumers have with digital payments is data privacy and security. This is why companies must take the proper measures to mitigate this type of risk overall, especially when they are focusing on a hybrid environment.

The proper set-up and educated employees can go a long way in keeping customer data safe and avoiding costly data breaches that put their bottom line and reputation at serious risk.

Final Thoughts

Consumers want to be able to have their cake and eat it too. And because financial institutions want to maintain a positive user experience and retain customers throughout this pandemic world that we are all currently wrapped up in, consumers are likely to get just what they want sooner rather than later.

![[ROCK NA] [EBOOK SEO] Complete Guide](https://rockcontent.com/wp-content/uploads/2024/06/banner_Search-Engine-Optimization.png)