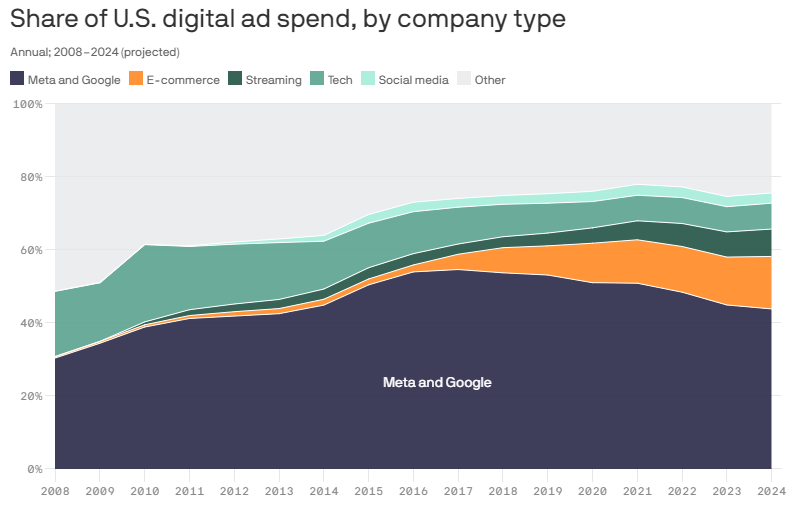

For years, Google and Meta have dominated digital advertising in the U.S. Now, they’re losing ground to giants like Amazon, TikTok, and Microsoft.

In a major shift, Google and Meta’s combined market share of the digital advertising industry in the United States is expected to drop below 50% for the first time since 2014, according to research group Insider Intelligence. This will result in Google representing 28.8% and Meta 19.6% in 2022, compared to their combined peak of 54.7% (with 34.7% belonging to Google and 20% going to Meta) back in 2017—their best year yet.

So, what has changed? How does it affect advertisers? Let’s explore this topic in detail so you can make educated decisions about how best to utilize them for your business’s benefit.

The Big Shift

Google and Meta are facing an increasingly competitive landscape with powerful new players.

Now we have publishers, social media, streamers, e-commerce companies, and beyond, all fighting for attention.

Our everyday experiences are saturated with screens. From work computers to mobile devices and TVs, every second a consumer spends near a device offers an opportunity for brands to deliver impactful advertising.

Companies compete tenaciously for a piece of the $300B digital advertising market as global advertisers’ budgets shrink amidst rising interest rates and inflation.

Many companies are emulating Google and Facebook by creating self-service ad platforms that offer a straightforward way for advertisers to purchase ads.

Companies like Amazon, TikTok, and Microsoft already capture a great amount of first-party data while providing value to their users. First-party data tracking allows new players to understand people’s preferences, needs, and wants, which will also help sell them products and services more precisely. This precision leads to more effective use of marketing dollars on ads while relying less and less on third-party data. In the wake of privacy measures implemented most prominently by Apple, that’s become more of a necessity.

Mark Zuckerberg, CEO of Meta, has claimed that revenue losses are partly due to Apple’s user-privacy updates, which hinder tracking capabilities and targeted advertisements.

As a result of increased competition and privacy challenges, Google and Meta’s market share is shrinking.

A New Player on the Scene: Amazon

Amazon is becoming a significant player in digital advertising. After acquiring Sizmek in April 2019, Amazon Advertising now controls the world’s largest ad server and eCommerce platform.

Like Walmart and eBay, Amazon is now taking advantage of its robust digital ad network to increase the visibility of products in its marketplace.

Amazon didn’t stop there—it stretched its on-site ads venture over its own e-commerce platform. This has allowed them to offer advertisers more options for targeting users and measuring their results.

Amazon is now the biggest threat to Google and Meta’s market share, and it’s growing fast. The company has expanded its ad business to more than $30B per year, and by 2024 it is expected to capture nearly 13% of the U.S. digital advertising market.

Talk Business With Microsoft

Microsoft is making its presence felt in digital advertising as well. The company recently acquired LinkedIn Ads, which became a significant player in the B2B market. With access to more than 610 million professionals, Microsoft can now offer advertisers a larger pool of potential customers and gain insights into their behavior.

LinkedIn offers exclusive advertising targeting capabilities not available on any other social platform. It allows you to specify key identifiers such as job title, seniority level, and industry, so only the most relevant ads are served to your intended audience.

Microsoft has also been making major investments in its search engine, Bing. In 2018, Microsoft invested heavily in developing a more intelligent and user-friendly search experience for users across devices, making it a viable option for advertisers looking to reach new customers.

Since then, Bing’s market share has grown from 5.79% to nearly 9% of the global search market, while market-leader Google has a share of around 83%.

In December 2021, Microsoft made a strategic move by acquiring Xandr—an advanced programmatic advertising platform owned by the telecommunications giant AT&T. Through Xandr’s data-driven technology platform, advertisers and content holders can join forces and construct powerful first-party ad solutions across a vast network.

With this move, Microsoft opened itself to new big partnerships like the one with Netflix. The new Netflix Basic with Ads tier is powered by Microsoft + Xandr’s full-scale technology platform.

Microsoft’s ad properties include Bing search, Xbox, MSN, and many other websites that use Xandr to sell digital ads.

TikTok Is Here to Stay

TikTok is making a big splash in digital advertising. It’s estimated that by 2024 TikTok will exceed US$8B in ad revenue—putting it firmly in fifth place for market share behind Microsoft (LinkedIn).

TikTok, as a newcomer to the advertising world, has made significant progress in ensuring advertisers experience an effortless process.

Similar to Meta Business Manager’s interface, TikTok has its own pixel that can be installed on websites for optimization of information gathering purposes.

TikTok’s growth is largely due to the platform’s ability to reach younger audiences and create engaging content. It provides advertisers with new opportunities to reach millennials and Gen Z, who are increasingly spending more time on their phones.

With its massive audience reach and ability to precisely target specific audiences, TikTok is here to stay.

What Does This Mean for Advertisers?

As you can see, the digital advertising landscape is changing rapidly—and so are business opportunities. By taking advantage of multiple platforms for campaigns, instead of relying solely on Google or Meta, advertisers can reach a wider audience and gain more visibility for their products and services.

Additionally, by understanding how each platform differs from one another—from targeting capabilities to cost per click (CPC)—advertisers can develop effective strategies that maximize their ROI while still staying within budget constraints.

Foreseeing new opportunities and capitalizing on them can make all the difference in delivering effective campaigns.

Now is the perfect time for brands to take advantage.

Conclusion

It’s clear that Google and Meta have lost some of their dominance in digital advertising over recent years—but there are still plenty of opportunities for savvy marketers who know how to use all available platforms effectively.

By embracing new technologies like Amazon Advertising, TikTok Ads, and Microsoft Ads, advertisers can optimize their campaigns and reach wider audiences than ever before.

When selecting the platform for your product or service, always consider your target audience and what will yield the most conversions. Set key performance indicators accordingly, and then test creative content to see which works best. After gathering data, you’ll have a clearer understanding of how to proceed efficiently.

Brands must produce fresh content, disseminate it, and gain insight from its performance to refine their long-term strategies in organic or paid channels. Remember that if you need content, you’re in the right place. Just reach out to Rock Content to learn more about our content creation offers.

Do you want to continue to be updated with Marketing best practices? I strongly suggest that you subscribe to The Beat, Rock Content’s interactive newsletter. There, you’ll find all the trends that matter in the Digital Marketing landscape. See you there!